Brendan Murphy, Head of Hydrogen, LCP Delta

03/09/2025 | Green hydrogen

The role of Hydrogen in the 2030s: how it can play a key role in the energy transition

The development of the green hydrogen market has entered its “sensible” phase. Following years of hype and hydrogen being the silver bullet, our latest analysis at LCP Delta shows the European and UK market is becoming much clearer about the role of hydrogen and where the investable opportunities now sit. With a new UK Hydrogen strategy on the horizon, this should provide greater clarity on what’s next for the sector and the role it can play in providing a secure and affordable energy transition.

Future Energy System

Current market conditions and what it means for hydrogen

High retail energy costs and high inflation are causing some to challenges on the pathway to net zero. At this critical juncture, Government and the National Energy System Operator (NESO) have some big decisions to make on to what to do with the hardest parts of the economy to decarbonise – areas where we believe hydrogen will play a crucial role. Done well, we can reduce our exposure to international gas price spikes and take some of the sting out of retail bills and industrial energy costs over time. Done poorly, hydrogen infrastructure risks layering costs onto consumers and UK plc without delivering resilience.

It has been a rocky few years since the UK published its first Hydrogen Strategy in 2021. The lingering impact of the energy crisis, recent political change and policy uncertainty has left a significant impact on investor confidence in hydrogen’s role as a clean energy solution. This has subsequently flowed through into downgraded forecasts.

However, we are now on the verge of getting a significant refresh of this 2021 Hydrogen Strategy, with a pivot towards sensible demand-led, bottom-up policy, and away from the top-down target of 6GW of capacity of green hydrogen production by 2030 – a target that we are nowhere near on track to meet. With a fair wind, LCP Delta currently forecasts installed capacity of between 2–3GW of green hydrogen.

Absolutely essential to the success of this new strategy will be designing policies that integrate the hydrogen ecosystem fully into the wider energy system. Hydrogen has to be a multi-purpose clean energy source focussed on specific parts of the economy, and potentially, has to be to be an important solution in the mix for enabling for a fully clean power system supporting net zero economy in 2050. At a strategic level, LCP Delta’s modelling shows that you for new offshore wind to remain investable from in the 2030s and 40s, we will need tens of gigawatts (GW) of electrolysis on the system in 2050. This hydrogen will be essential for the clean thermal generation needed to balance the power system, and for multiple sectors across industry and transport, where it is becoming increasingly clear electrification is not always the best option. The narrative that everything should be electrified often doesn’t make practical sense in an agricultural, construction, or many heavy industries setting.

Recent modelling for our client, Haldane Energy, a developer of closed-loop hydrogen to power (H2P) projects, essentially H2P long duration energy storage (LDES), also clearly showed that policy makers must be enablers of innovation. Different technologies are often supported through separate policy ‘buckets’; however, policymakers should focus on removing obstacles for solutions which seek to creatively combine different technologies... Supporting these new approaches could be key to meeting these significant energy transition goals. Our analysis found that H2P LDES acts to maximise the efficient use of renewables and support more efficient investment in wind generation, by reducing the need for 3.6GW of capacity of wind for every 1GW of H2 LDES capacity installed, to achieve the same level of emissions, significantly reducing overall CapEx and OpEx costs by £ billions. Another way to put this is that this is the equivalent of almost two Hornsea 4 offshore wind arrays per 1GW of H2 LDES.

So, what is needed to make hydrogen a success?

On paper, the UK aims for 6GW of green hydrogen production by 2030: in reality, our view of the risked pipelines suggests we’re nowhere on track to get near this. What the UK does have, however, is a generous and bankable Hydrogen Production Business Model (HPBM). Given today’s gas benchmarks, public support equates to roughly £9.50/kg for early projects, materially higher than the first EU Hydrogen Bank round. This certainly does reduce developer revenue risk and should accelerate final investment decisions — exactly what the Original Equipment Manufacturer (OEM) and developer ecosystem needs from 2025–28.

Europe is moving from local projects to regional clusters and, in the 2030s, to a traded hydrogen market. In the UK we should ensure storage and transmission planning (and business models) catch up rapidly to where things are when it comes to production. If not, we’ll strand early assets and lock in higher costs. For example, last year final investment decision was taken on Germany’s Core Hydrogen Network (backed by €24bn loan from KfW Development Bank), marking a key milestone for Europe’s clean hydrogen transition. The network will connect industrial hubs across Germany with domestic and imported hydrogen, and to be fully developed by 2032. The lesson from the continental market is simple: pipes, storage, and power-purchase agreements (PPAs) are what make molecules bankable.

Keep an eye on support intensity

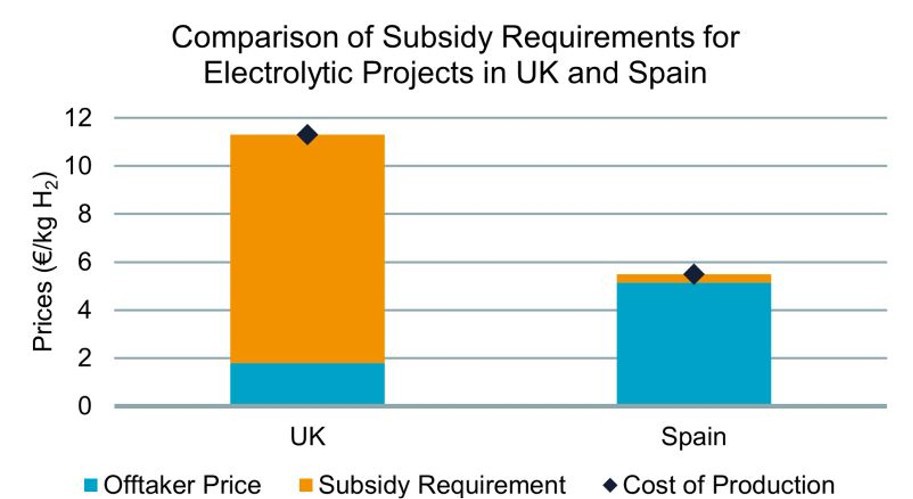

Hydrogen Allocation Round1’s (HAR) implied support level is high compared with the EU’s first auctions. This is partly because the cost of production in the UK is significantly higher due to the UK having some of the highest electricity prices in Europe, and because there are strong regulatory drivers for offtakers to switch to hydrogen. This is all neatly illustrated in Figure 1 below.

So, what should consumers expect?

There are no silver bullets — and certainly there is no prospect of an overnight drop in bills. But there is a credible route to fewer “energy crisis” price spikes, reduced costs of curtailment and balancing the system, and reduced exposure to global gas swings as we head through the 2030s. In household terms, that translates less into dramatic bill cuts and more into predictability: a system that is cheaper to insure because it genuinely needs less insurance. LCP Delta’s 2024 customer research showed that customers are deeply worried both energy costs and price volatility, with 74% actively monitoring energy prices, and 89% actually changing energy consumption behaviour.

The path there is narrow but navigable by taking the right steps. Removing the policy difficulties to the uptake of hydrogen by driving demand across a range of sectors where the UK wants to play, accelerating the development of the enabling infrastructure of networks & storage, and driving support costs down allocation-round by allocation-round is the way forward. Europe’s data tells us the market is maturing — later than hoped, but on firmer footing. If the UK leans into those lessons now, the 2030s can be the decade we stop paying for volatility and start paying for value. In the UK we are on the verge of buying today the system that we use in the 2030s.

If you are interested in reading more about LCP Delta’s work in this space, feel free to read our state of the market report on the European green hydrogen market, and please reach out to the LCP Delta team.

LCP Delta is also excited to be supporting and attending RenewableUK’s Future Energy System 2025 this September which will explore the role of green hydrogen and other flexible technologies needed to support a reliable, resilient, renewable energy system. I will be speaking on panel A2 ‘powering ambition with clean hydrogen’. I hope to see you there!