Nick Hibberd, Policy Manager and Sam Sheppard, Senior Communications and Campaigns Manager

19/12/2025 | Energy markets

How do Allocation Rounds work, and what are CfDs?

Annual clean power auctions, known as Allocation Rounds, are the primary way the Government unlocks investment in new offshore and onshore wind, solar and tidal energy projects. Successful projects are awarded ‘Contracts for Difference’ (CfDs) to generate clean power.

What is the CfD scheme?

The Contracts for Difference (CfD) scheme is the Government’s main mechanism for unlocking investment in low-carbon electricity generation. It’s essentially an auction for power contracts between generators and Government. Since its introduction in 2014, the CfD scheme has been hugely successful in supporting the expansion of homegrown clean energy, driving down costs to consumers and incentivising technological innovation.

In fact, it’s been so successful many countries around the world have subsequently copied it, with the EU in the process of finalising regulations to ensure national-level support schemes across Europe follow the two-way CfD model.

In the UK, the 20-year CfD contracts awarded via the auction are between a low carbon electricity generator (e.g. a developer of a solar farm) and the Government-owned Low Carbon Contracts Company (LCCC). Developers of new clean energy projects bid in a competitive auction to receive a contract which guarantees a fixed price for the electricity they generate.

Allocation Round 7 (AR7) refers to the seventh allocation round of the CfD scheme. The results for this latest round will be announced by the Government in January and February 2026.

How do CfDs benefit consumers?

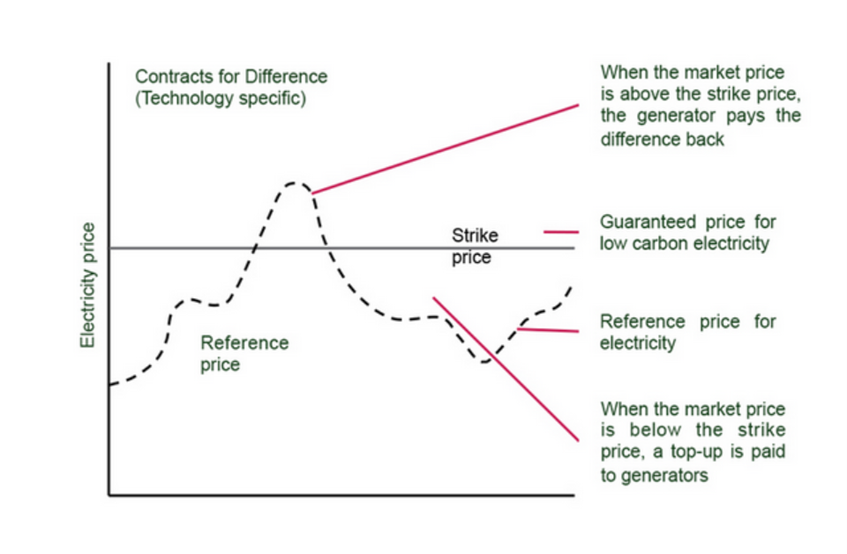

The electricity market is highly volatile and the market price can change dramatically, so a mechanism to ensure stability is desirable to both protect consumers and provide a stable revenue stream for investors. CfD contracts address this by agreeing a fixed ‘strike price’, which represents the price the project will receive for each megawatt hour (MWh) of electricity it generates during the contracted period.

This strike price is then measured against the market price of electricity over the course of the contract. When the market price is higher than the strike price, the generator pays back the difference to the consumer via the LCCC. When it is lower, the LCCC tops up the generator via electricity bills.

By fixing prices, CfDs also significantly reduce the risk investors are exposed to. This reduction in risk lowers the costs of financing projects by enabling capital to be borrowed on more favourable terms, making wind farms cheaper than they would be otherwise. This is vital as a huge amount of the costs of renewable energy projects are up-front capital costs (i.e. manufacturing and building the wind farms), with remaining costs over the lifetime of the project much lower than other sources of generation (largely because, unlike nuclear and gas plants which pay for their fuel, the wind is free).

Recent analysis has found that a future UK electricity system, and Europe-wide system, powered by offshore wind is lower cost for billpayers than alternatives, including unabated gas.

How does a CfD auction work?

CfD contracts are awarded through annual auctions or ‘Allocation Rounds’. To enter an auction, developers need to satisfy the eligibility requirements and confirm the size of their project, the year it will start delivering power and, most importantly, a sealed bid stating the price they can provide each MWh of electricity their project produces at – the strike price.

The Government caps the maximum a project can bid by setting the highest price it is willing to offer, known as the ‘Administrative Strike Price’ (ASP), which a developer cannot bid above. The Government then awards contracts to bidders with the lowest strike price(s) until the auction budget has been spent. Crucially, sealed bids keep prices low by ensuring developers cannot see the bids of other projects.

What is the budget?

The budget is set by the Government and acts as a means of controlling the total number of projects that can secure contracts within a given auction. It is a limit on the number of projects that can win a CfD, rather than a fixed cost.

Somewhat confusingly, the budget is not a reflection of how much the projects will actually cost, the impact of the projects on public spending, or the total impact on consumer bills.

The budget is rather dictated by the difference between the strike price and an estimate of the average market price for electricity for renewable energy, known as the ‘reference price’. When the reference price is low, the budget needed to support a given project is higher, and vice-versa.

In reality, however, the actual market price of electricity will vary (and is typically much higher than the ‘reference price’ used to set the budget). Whilst we don’t have a crystal ball, meaning future CfD costs and precise consumer benefits will always be unknown at the time of the auction, the fixed price hedges against this uncertainty.

What is the significance of AR7?

Ahead of AR7, the UK has a record amount of offshore wind capacity eligible to bid in - more than 20 gigawatts - which could attract up to £53 billion in private investment in the UK economy.

This year’s auction has seen significant delays compared to previous years, due to a series of reforms to the CfD process, including the introduction of 20-year contracts.

Besides providing lower-cost clean electricity, a successful AR7 that maximises investment in renewable energy projects will bring many wider benefits to the UK, including:

- New jobs across the country - renewable energy projects create jobs across the UK in hubs such as Grimsby, the Solent, East Anglia, Aberdeenshire, the Humber and North Wales, while floating offshore wind opens up opportunities in areas across North-East England, the Celtic Sea, North Scotland and Irish waters. If the UK achieves its offshore wind targets through strong allocation rounds, it is estimated that offshore wind could employ over 90,000 people by 2030, with the onshore wind sector supporting almost 20,000 jobs.

- A boost to the economy - a strong pipeline of renewable energy projects through AR7 will trigger billions in private investment and support new investment in the UK's domestic manufacturing and supply chain. A strong project pipeline is critical to seizing the offshore wind industrial opportunity - trebling the UK’s offshore wind manufacturing base and adding a further £25 billion to the UK economy between now and 2035.

- Greater energy security - maximising investment in AR7 will reduce our reliance on international gas. The eligible offshore wind projects alone could provide electricity for more than 20 million homes and maximising procurement and investment would significantly reduce the UK’s current gas imports.