Daniel Sutherland, Data Analyst

03/09/2025 | EnergyPulse

Stacking up the storage: where the UK battery market stands in 2025

3 September 2025 - EnergyPulse blog

In December 2024, EnergyPulse published our inaugural blog post summarising the battery storage pipeline in the UK. With RenewableUK’s highly anticipated Future Energy System event just around the corner on 10 September, we thought it would be helpful to provide an update to the pipeline figures.

The UK's energy landscape is undergoing an unprecedented transformation, with renewables supplying ever-more of our electricity and demand for electricity growing, which means an increased need for flexible storage assets like battery energy storage systems (BESS). But what battery assets does the UK boast currently? How much capacity is under construction and consented, and what has the growth journey of battery storage projects looked like?

Future Energy System

The UK battery storage pipeline at a glance

1943

Active* UK battery storage projects

509%

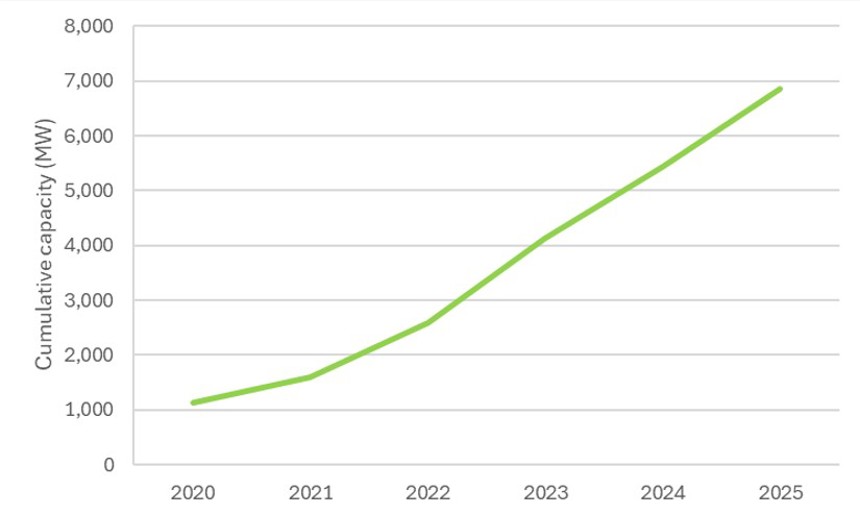

Increase in UK battery storage capacity** from 2020 to 2025

6,872MW

Total operational UK battery storage capacity

1,405MW

UK battery capacity commissioned in 2025 to date

At present, the UK has more than 6.8GW/10.5GWh of operational battery storage. 79% of this capacity is in England, 16% in Scotland, 3% in Northern Ireland and the remaining 2% in Wales. In 2025 to date, approximately 1,405MW of new battery storage capacity has been commissioned, already surpassing the 2024 total of 1,249MW.

Battery storage projects consented and under construction

According to EnergyPulse’s research there is approximately 6.5GW of capacity currently under construction and over 60GW of capacity currently consented. Notably, there are 25 projects consented with capacity greater than 500MW.

The largest projects currently under construction are Coalburn and Coalburn II. The projects are 2-hour duration with a combined capacity of 1GW (500MW each). Construction of Coalburn began in January 2025, with the construction of Coalburn II following shortly after in February. Both projects have been developed by Alcemi Storage Developments Limited, and are located East of Coalburn, South Lanarkshire. The developer expects Coalburn to be operational in 2025, followed by Coalburn II in 2027.

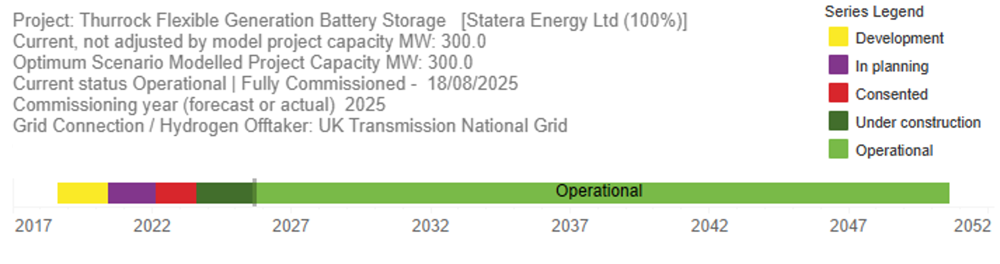

Growth of the pipeline

Since 2020 the operational battery storage capacity in the UK has grown 509%, from 1,128MW in 2020 to 6,872MW in 2025. The total has been bolstered this year by the commissioning of projects such as Phase 1 of Zenobe’s Blackhillock (200MW) and Statera’s Thurrock Flexible Generation Facility (300MW), the latter becoming the largest battery storage asset commissioned in the UK to date.

Plans for the Thurrock BESS were originally submitted in 2020 and consented in 2022, construction began in August 2023 and was completed in August 2025.

Related content

Although commissioned battery storage capacity dropped from 2023 to 2024 (as reported in our last battery storage related blog post), 2025 has the potential to surpass the 2023 total for commissioning. In 2023 1,799MW of capacity was commissioned, 2025’s year to date figure of 1,405MW leaves 394MW to go.

With many projects under construction nearing completion, it is highly likely that 2025 will be the most successful year for battery storage asset commissioning on record.

How can I access this data?

EnergyPulse stores and provides this data via RenewableUK membership or via subscription. Alongside up-to-date information, EnergyPulse also provides a modelled forecast of how the pipeline will look in years to come, as well as a plethora of data points for global offshore wind and UK onshore wind, battery storage and hydrogen markets. In future editions of this blog, EnergyPulse will also explore grid connection dates, application approval rates, trends in colocation of projects and much more.

If you have any questions, comments or requests about this data or EnergyPulse in general please get in touch with me via email and I would be happy to help.

About EnergyPulse

RenewableUK’s EnergyPulse is the industry’s go-to market intelligence service for renewable energy news, project data and analysis. Delivering comprehensive and accurate renewable energy data, insights and dashboards for the wind, marine, energy storage and green hydrogen sectors in the UK – and offshore wind globally.

Data correct as of 2 September 2025

Footnotes

*Active battery storage projects

Active refers to projects that have seen any development activity in the most recent 4-year period.

**Modelling battery storage capacity in MW and MWh

Where the capacity of a particular project is not specified by the owner publicly, RenewableUK has modelled a MW capacity based on the battery’s footprint relative to other projects where the capacity and footprint are known. Where a MWh value for a project is not known, then it is modelled using assumptions which have been made by researching built or soon to be built projects where MW and MWh are known:

- Projects less than or equal to 50MW are assumed to have a duration of 1-hour, therefore a 25MW project where there is no MWh stated will be modelled as having a capacity of 25MWh.

- Projects greater than 50MW are modelled to have a 2-hour duration.

Disclaimer

Data is accurate to the best of RenewableUK’s knowledge and is a high-level snapshot of the information available in the renewable energy database. Projections do not represent a RenewableUK position and should be used only as guides to possible outcomes. RenewableUK takes no responsibility for losses incurred by the use of this information.